by Cesar Navas

June 7, 2016

The Payment Card Industry Security Standards Council (PCI SSC) maintains, evolves and promotes Payment Card Industry standards for the safety of cardholder data across the globe. The PCI SSC provides technical and operational requirements for organizations accepting or processing payment transactions. The guidance also applies for software developers and manufacturers of applications and devices used in those transactions.

The Payment Card Industry Data Security Standard (PCI DSS) helps entities understand and implement standards for security policies, technologies and ongoing processes that protect their payment systems from breaches and theft of cardholder data. The standards have historically been revised on a 2-3 year cycle, but the PCI SSC is transitioning to a posture of revising the PCI DSS as required based on changes to the current threat landscape. The current standard revision is PCI DSS Version 4.x. Any organization that handles payment card information must comply with the PCI DSS and must demonstrate compliance annually. Tenable Security Center is able to help organizations monitor ongoing PCI DSS compliance.

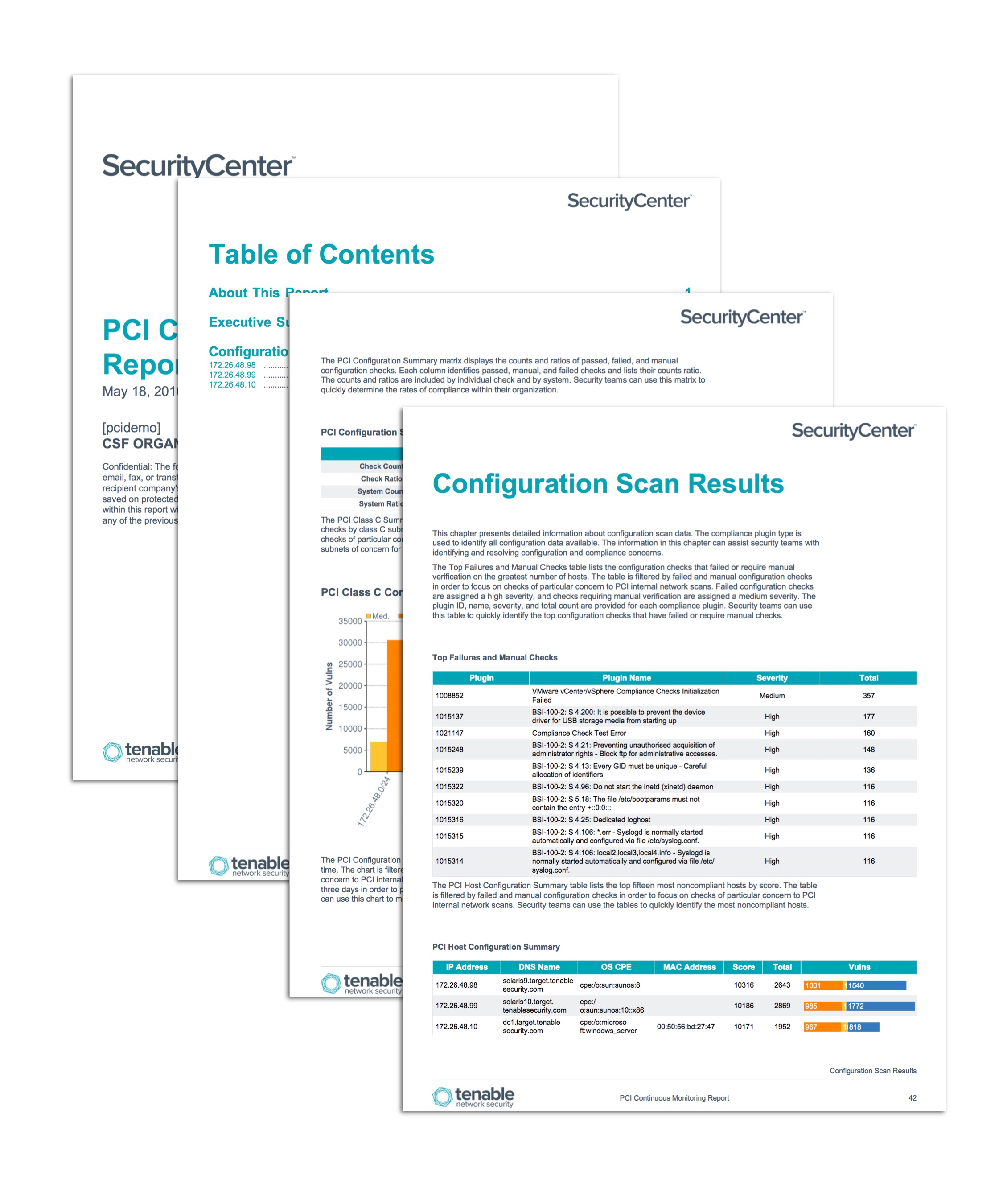

The PCI Configuration Audit report presents extensive data about the configuration status of the network based on the available data. The report can be used to gain insight into all configuration results, or it can be modified to focus exclusively on the results of a PCI internal network vulnerability scan. Organizations can configure repositories or asset lists in order to tailor the focus of the report. When the report is added from the Tenable Security Center Feed, the appropriate assets, IP addresses, or repositories can be specified. Assigning one of the options to the report will update all filters in the report. Security teams can use this report to identify and monitor configuration adjustments across the organization.

A highly detailed section of this report focuses on configuration data gathered from all available configuration scan results. The elements in this chapter are filtered for failed and manual configuration checks based on severity. Failed configuration checks are identified as high severity, and checks requiring manual verification are identified as medium severity. Identifying and then remediating failed configuration checks is especially important to ensuring ongoing compliance with the PCI DSS. Configuration checks are tracked by time, severity, and subnet in order to provide a thorough perspective on the configuration status of the network.

This report is available in the Tenable Security Center Feed, a comprehensive collection of dashboards, reports, Assurance Report Cards, and assets. The report can be easily located in the Feed under the category Compliance & Configuration Assessments. The report requirements are:

- Tenable Security Center

- Nessus

Tenable Security Center provides continuous network monitoring, vulnerability identification, risk reduction, and compliance monitoring. Tenable Security Center continuously updated with information about advanced threats and zero-day vulnerabilities, as well as new types of regulatory compliance configuration audits. Nessus Network Monitor (NNM) performs deep packet inspection to enable discovery and assessment of operating systems, network devices, databases, and critical infrastructure. Tenable Security Center enables extensive vulnerability and malware detection, data flow analysis, user and anomalous behavior monitoring, intrusion detection, and change management monitoring. By integrating with Nessus, NNM, and Tenable Security Center, continuous network monitoring is able to detect and monitor systems and vulnerabilities across the enterprise.

This report contains the following chapters:

- Executive Summary: This chapter presents a high-level overview of the [vulnerability and/or configuration] status of the network. Vulnerabilities and configuration results are tracked by time, severity, and subnet. The chapter provides a quick reference for tracking remediation progress.

- Configuration Scan Results: This chapter presents detailed information about configuration scan data. The compliance plugin type is used to identify all configuration data available. The information in this chapter can assist security teams with identifying and resolving configuration and compliance concerns.